The FRED graph above depicts the St. Louis Fed’s Financial Stress Index (STLFSI). This data series in FRED was created in 2010 to measure changes in U.S. financial market conditions in response to a broad array of macroeconomic and financial developments. In particular, the STLFSI is designed to quantify financial market stress. There’s no specific definition for financial market stress, but periods of stress have historically been characterized by increased volatility of asset prices, reduced market liquidity conditions, or the narrowing or widening of key interest rate spreads. The STLFSI is constructed using 18 key indicators of financial market conditions—7 interest rates, 6 yield spreads, and 5 other indicators.

In late 2021, some Federal Reserve officials encouraged financial market participants and others to consider using an alternative short-term interest rate benchmark because of concerns about the eventual retirement of the London interbank offered rate (LIBOR). Since the STLFSI had two yield spreads based on the LIBOR, we replaced the LIBOR rate with the secured overnight financing rate (SOFR). Specifically, we shifted to the 90-day average SOFR. This rate measures the compounded average of the SOFR over a rolling 90-day period. In other words, it’s a backward-looking measure. We showed that the correlation between the previous version (STLFSI2) and the new version (STLFSI3) was 0.99 over the sample period dating back to December 1993. Click here for details and more information about this switch.

In 2022, we received numerous inquiries about the behavior of the STLFSI during the year. Most asked why the STLFSI was continuing to indicate lower-than-average levels of financial market stress, while other measures showed a “tightening” in financial market conditions. The divergence between the STLFSI and other indexes occurred more or less at the time when the Federal Open Market Committee (FOMC) began to signal its intent to raise its federal funds rate target in March 2022 and, importantly, subsequently signaled that further increases in the policy rate were likely in 2022—and perhaps in 2023.

Our analysis showed that instead of using the 90-day backward-looking SOFR rate, we should have used the 90-day forward-looking SOFR rate. In our view, using the forward-looking SOFR better captures financial market expectations in response to expected changes in the federal funds rate and its attendant effects on other asset prices and yields.

The second FRED graph plots the STLFSI4 and the STLFSI3 since early January 2020—just prior to the financial market turmoil and deep recession spawned by business and government actions designed to counteract the COVID-19 virus. In the graph, the two versions track each other closely over most of this period. But the close comovement began to erode in early February 2022, as it became clear that the FOMC was poised to begin raising its policy rate to combat an inflation rate that was the highest in 40 years. For example, the correlation between STLFSI3 and STLFSI4 was 0.993 from the week ending December 31, 1993, to the week ending January 28, 2022. Since the week ending February 4, 2022, the correlation has declined to 0.526.

A final takeaway from this second graph is that the new measure of the STLFSI shows that financial market stresses during the current Fed tightening episode are moderately higher compared with the previous version. Still, levels of financial market stress are currently near their historical levels. (In the index, zero is designed to be an “average” level of stress.) Moreover, the current Fed tightening episode has not triggered the kind of financial market stress seen during the heights of the pandemic-spawned shutdowns in the economy.

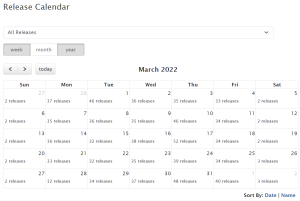

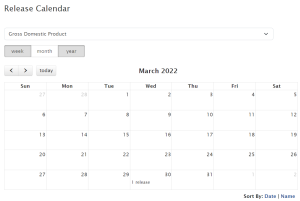

How these graphs were created: Search FRED for “Financial Stress Index” and make sure to take version 4. For the second graph, take the first, click on “edit graph,” open the “add line” tab, and search for “Financial Stress Index,” making sure to take version 3.

Suggested by Cassandra Marks, Kevin Kliesen, and Michael McCracken.