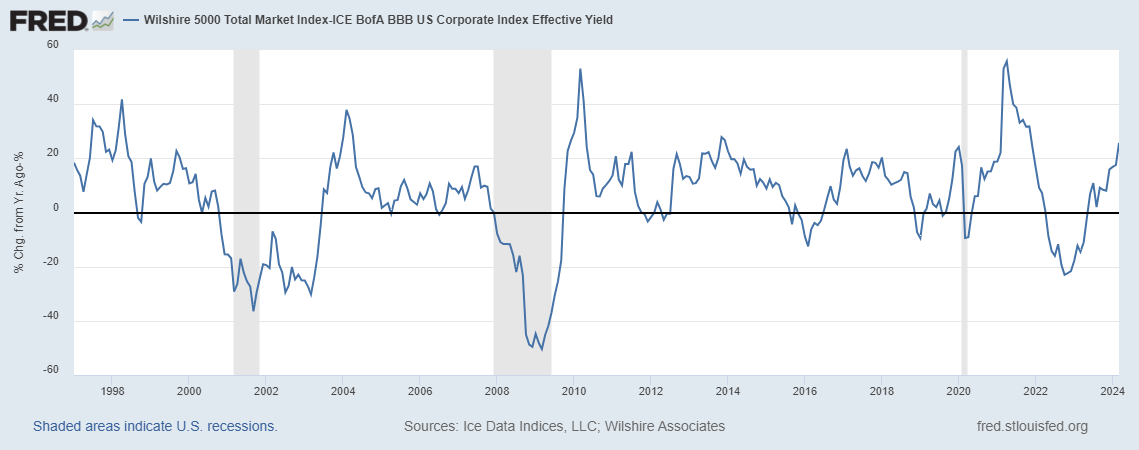

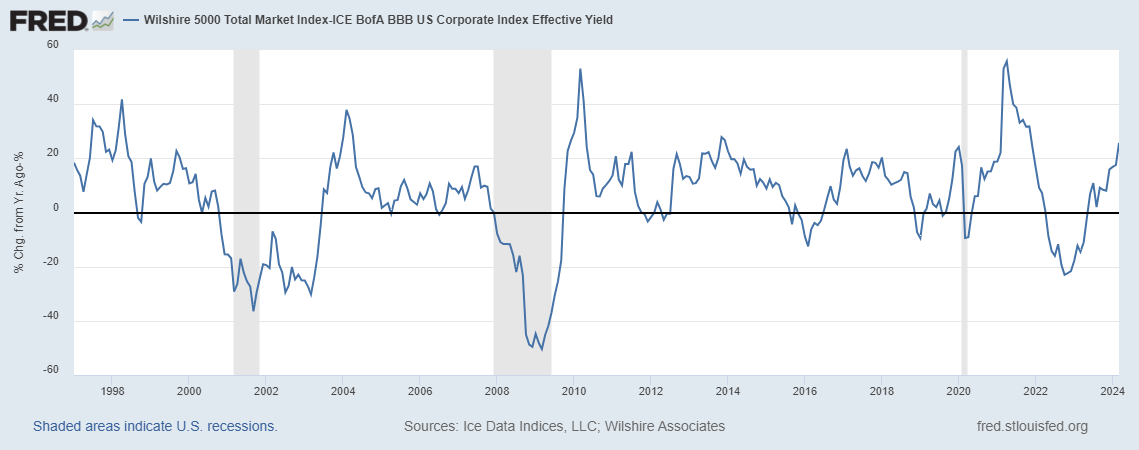

The equity premium is the difference between the return on a stock and the return on a bond. Typically, it’s positive—meaning stock returns are higher—although it can be negative when the stock market goes through some rough times. Over the long run, it’s definitively positive because bonds are senior to stocks in any liquidation: Bonds carry less risk and, therefore, less yield. Measuring the equity premium is tricky, though. To do it right, you must compare stocks and bonds from firms of similar quality and aggregate over many firms to smooth out anecdotal evidence and small-sample errors. Using broad indexes may also be distorting, as the firm composition may not be comparable between stock and bond indexes.

In the graph above, FRED shows one of the many examples of how you can measure the equity premium with available data, using here the very broad Wilshire 5000 index for stocks and the BofA Merrill Lynch BBB index for bonds. (BBB is a category that may be somewhat representative: not very safe but not very risky, either.) You can experiment on FRED with many other combinations. Again, you’ll find the result is positive most of the time, reflecting the simple investment advice that if saving for the long-run warrants a diversified portfolio of stocks.

How this graph was created: Search for “Wilshire 5000” and choose the total market index. Change units to “Percent Change from Year Ago.” In the “Edit Line” tab, add the second series by search for “BBB effective yield.” Customize the data by applying the formula a-b. Finally, change the frequency to monthly to make the graph less noisy.

Suggested by Christian Zimmermann.