This FRED graph compares expected inflation and actual inflation. In recent years, expectations (in red) have been consistently above realizations (in blue). Why?

How people form expectations is a fascinating topic, as expectations drive so many economic decisions. One important point here is that, individually, we notice relatively few prices in an inflation measure. That is, individuals buy fewer goods than are included in the basket that determines the CPI. Also, we tend to recall only a few of the prices we encounter, in particular those that changed or changed more than we might have expected. (Read more about individual perceptions and bias.)

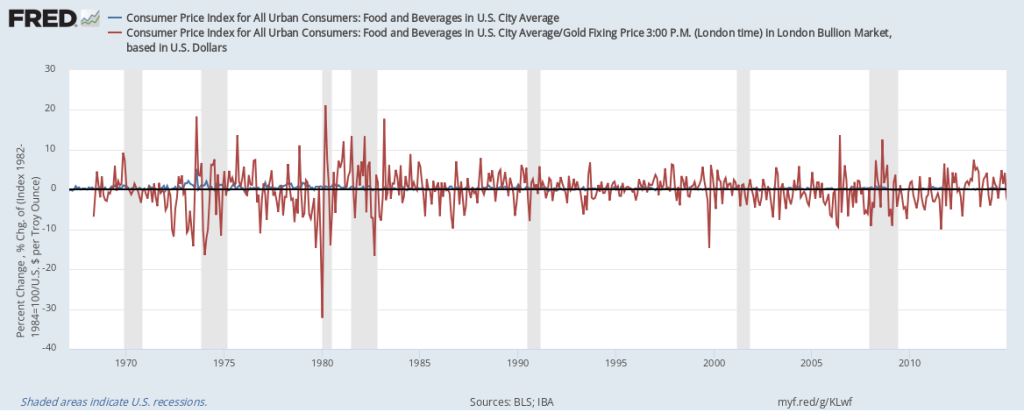

The graph below shows there’s quite a bit of variance in price changes across categories of goods. As expectations of future inflation are largely determined by perceptions of past inflation, the end result is an upward bias in expectations.

How these graphs were created: For the first graph, click on the CPI link on the FRED home page: Use the “Edit Graph” panel to change units to “Percent change from year ago.” Use the “Add Line” tab to search for “inflation expectation” and use the Michigan index. Restrict the sample period to start in 2017. For the second graph, start from the CPI release table, check the desired components, and click “Add to Graph.” Then use the “Edit Graph” panel to change the frequency of each line to “Annual, end of period.” Finally, in the “Format” tab, change graph type to “Bar”, close the tabs, and select period 2017-01-01 to 2020-01-01.

Suggested by Christian Zimmermann.