Smack in the middle of summer, you may find yourself with more free time, a freewheeling attitude, and maybe a wild inclination to pick up a new hobby, like spikeball… Or maybe even try out the hot new investment—cryptocurrency!

In short, cryptocurrency is a digital asset that is not regulated by a central authority, in the way money is regulated by the Federal Reserve System in the United States. No governing authority determines how much, by whom, or when crypto is produced or exchanged. Instead, the beauty of virtual currency is the “peer to peer network” and blockchain technology that makes it easier to transfer funds and more difficult to forge transactions.

The lack of collateral behind today’s cryptocurrencies is reminiscent of the pre-Civil War era of “free banking.” Back then, anyone with sufficient funds was able to open their own bank and issue their own notes, similar to the freedom available to a programmer who adds to the supply of crypto through mining. U.S. states that were successful at free banking used secure government bonds as backing. On the other hand, states that allowed low-security bonds and risky mortgages helped coin the term “wildcat banking”; these cases involved defaulted loans and bank notes that declined up to 60% in worth.

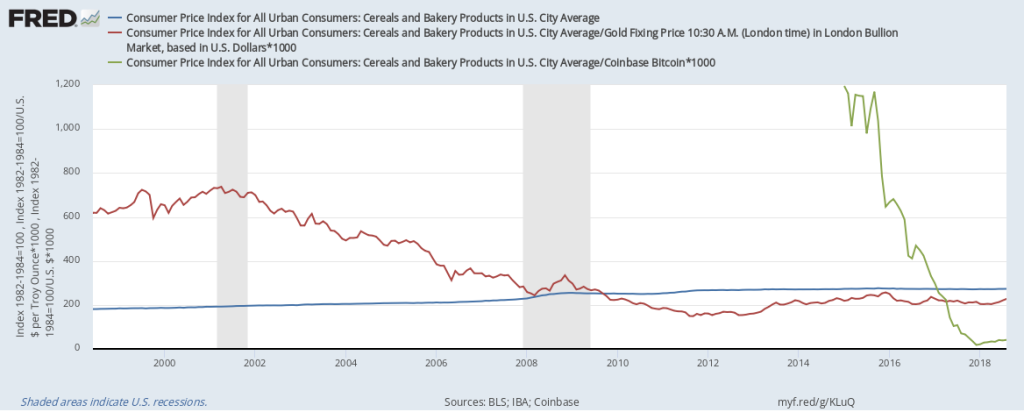

Bitcoin, one of the many types of cryptocurrency on the market today, is revered for its lack of regulation; however, this “freedom” also contributes to its notoriously volatile reputation. The above graph depicts Bitcoin’s price fluctuations (for example, from $20,000 in December 2017 to around $7,300 in mid-July 2018). In fact, a logarithmic scale is needed to best capture these fluctuations. (That is, the units are in U.S. dollars, but the distances between the lines can be interpreted as percentage differences; see an earlier post for more on logarithmic scale.)

At the CoinDesk Consensus, President James Bullard of the St. Louis Fed stated that “cryptocurrencies are creating drift toward a non-uniform currency in the U.S., a state of affairs that has existed historically but was disliked and eventually replaced.” Historically, investing in non-government-backed, non-uniform forms of currency has been risky. That said, blockchain technology also didn’t exist in pre-Civil War America.

How this graph was made: Search for “Coinbase,” select “Coinbase Bitcoin,” and click “Add to Graph.” From the “Edit Graph” panel, choose the “Format” tab and select the checkbox for “Log scale.” For graphs depicting rapid growth, consider using the log feature, available in every series on FRED: This helps to highlight small fluctuations in data points, linearizing the output.

Suggested by Elizabeth Tong and Christian Zimmermann.